Council Rates

Home > About Council > Council Rates

The funds generated from Council rates contribute to the provision of essential services within the City of Norwood Payneham & St Peters.

Rates are the main source of income for the Council. They fund essential services such as the management of infrastructure, public health and safety, as well as major capital projects, the provision of community programs,

as well as the many other functions that the Council is required to perform.

How Rates are Calculated

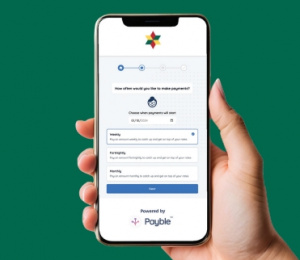

Pay Your Rates

Rebates and Concessions

Change of Address or Name

Email Rate Notices

Landscape Levy

Rating Policy

Property Information Searches - Section 7 & 187 Certificates

In this section:

- About Council

- About our City

- Mayor & Elected Members

- Council & Committees

- Latest news

- Strategic Planning

- Publications, Documents & Registers

- Council Policies

- Governance

- Council Rates

- Regional Subsidiaries

- Council Property

- Organisational Structure

- Feedback & Complaints

- Community Consultation

- Norwood Town Hall - Contact Us

- Careers

- Awards Won by Council

- Smart City